Debunking The 5 Most Common Retirement Myths and Assumptions

Financial generalizations are as old as time. Some have been around for decades, while others have only recently joined their ranks. Let’s examine a few.

Myth #1 – Retirement Means I Can Stop Investing

In the past, retirement was viewed as an “end” in many ways. These days though, retirement is often seen as an opportunity to return to one’s passions or just another of life’s many chapters. That doesn’t mean you should stop investing, however.

Myth #2 – My Taxes Will Be Lower

That depends on your situation. Some may earn less in retirement, which could lower their tax bracket which may reduce overall taxes. On the other hand, some retirees may end up losing the tax breaks they enjoyed while working. For more insight into your tax situation in retirement, speak with a tax or financial professional. They can help you manage withdrawals from your qualified retirement accounts

Myth #3 – I Started Saving Too Late, and Now Retirement Is Impossible

No matter how far behind you feel you are, don’t lose hope. Remember, you can make larger, catch-up contributions to your Individual Retirement Accounts (IRAs) after age 50. In fact, if you are 50 or older this year, you can put as much as $25,000 into a 401(k) plan.

Withdrawals from traditional IRAs and distributions from 401(k) plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

Myth #4 – Medicare Will Take Care of Me

Unfortunately, Medicare doesn’t cover extended care, if that’s the only care you need. Instead, extended care insurance is often the best choice when preparing for retirement.

Myth #5 – I’ll Live on Less When I’m Retired

Maybe. This one depends on how you approach retirement. In the later phase of retirement, people often choose to live on less. But for many, the first few years of retirement mean traveling and new adventures. In other words, taking a realistic look at where you would like to be in retirement makes all the difference when it comes to retirement costs.

At the end of the day, there is no “one-size-fits-all” retirement strategy. Every individual, couple, or family needs a strategy tailored to their situation, risk tolerance, and financial objectives. With proper preparation and the help of a valued financial professional, there’s no reason you can’t create a strategy tailored to whatever life has in store.

Disclosures:

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Explore More

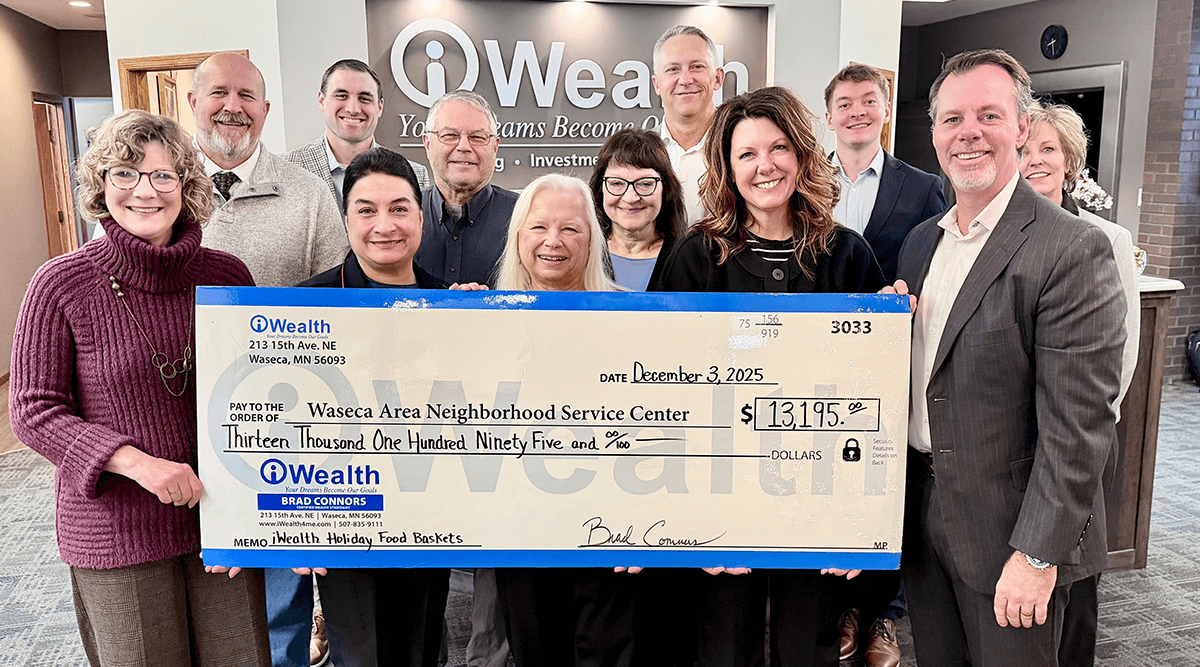

Sharing Warmth with the iWealth Holiday Food Baskets Drive

Giving Back iWealth Foundation

Brad Connors Obtains Certified Wealth Strategist® Designation

iWealth News Brad Connors

Bringing Hope and Food to Waseca Area Families

iWealth Foundation iWealth Holiday Food Baskets