iWealth Financial Resources

Helping You Pursue Your Financial Goals

Sign Up Today For Financial Education From iWealth

Whether you prefer to read, watch or listen, we have you covered!

iWealth TV

QCDs Explained – Turning Your RMD Into a Gift That Matters

Giving Back Generational Wealth Planning

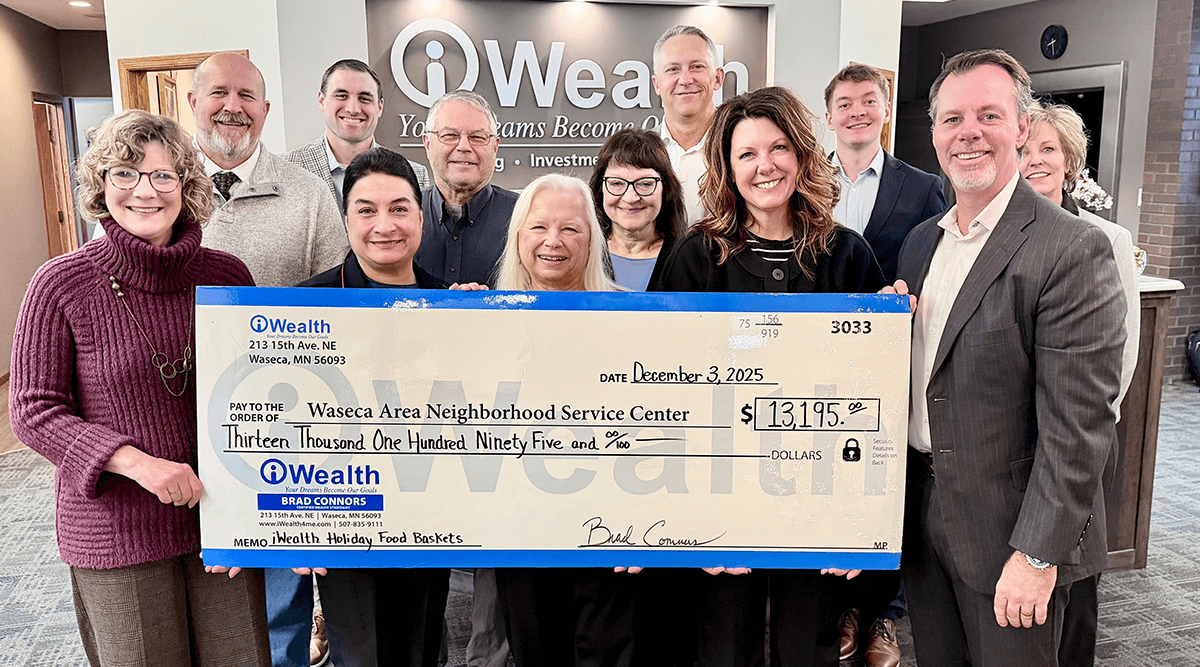

Sharing Warmth with the iWealth Holiday Food Baskets Drive

Giving Back iWealth Foundation

Strategic Year-End Gifting to Family and Charity

Generational Wealth Planning Leaving A Legacy

Finding Joy Through Giving and Financial Purpose

Giving Back Generational Wealth Planning

Fish Don’t Clap: Why You Might Change the Way You Think About Retirement

Retirement Plannning Holistic Financial Planning

Working Together Toward a Meaningful Retirement

Retirement Planning Investment Strategy

The Role of Personal Values in Generational Wealth Planning

Leaving A Legacy Generational Wealth Planning

Living the American Dream with Purpose – How Faith Family and Planning Define True Wealth

Holistic Financial Planning Generational Wealth Planning

Start Early – Financial Planning for Kids and Grandkids

Generational Planning Leaving A Legacy

Q3 2025 iWealth Stock Market Reflections

Quarterly Stock Market Update Investment Strategy

Financial Life Lessons from Our Player of the Game Athletes

Holistic Financial Planning Giving Back

How Charitable Giving Builds Stronger Families

Giving Back Generational Wealth Planning

Comprehensive Financial Planning Services in Minnesota

Comprehensive Financial Planning Quick Guide

Does Your Investment Strategy Reflect What Matters Most

Investment Strategy Financial Planning

How to Retire with Purpose Not Just a Stock Portfolio

Financial Planning Retirement Planning

Family Office Services for Affluent Families in Minnesota

Family Office Generational Wealth Planning

What Is Holistic Financial Planning and Why It Matters Today

Financial Planning Investment Strategy

Q2 2025 iWealth Stock Market Reflections

Quarterly Stock Market Update Investment Strategy