Let’s start this email with the conclusion: Stick with your investment strategy, and don’t let outside influences like the Fed get in your way.

Following the Fed these days is like watching an endless point in a tennis match. The back-and-forth is causing anxiety, anticipation, more anxiety, and confusion.

At its March meeting, Fed officials said they penciled in three quarter-point cuts in short-term rates by the end of 2024. But wait. Not so fast.1

In the following weeks, Atlanta Fed President Raphael Bostic suggested one cut. San Francisco Fed President Mary Daly noted no guarantees, and Cleveland’s President Loretta Mester said rate cuts may come later this year. Minneapolis President Neel Kashkari said that no cuts may be on the table, followed by Fed Governor Michelle Bowman, who said it’s possible rates may have to move higher to control inflation.2,3

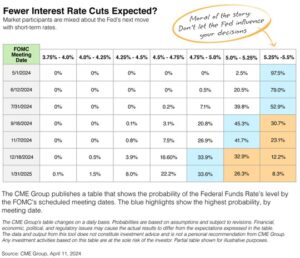

Confused? You’re not alone. So are the financial markets. As you can see in the table below, market speculators now anticipate only one, maybe two, cuts this year. But as the percentages show, there’s not much conviction in any outlook.

The April Consumer Price Index report only added to the confusion. When consumer prices came in a bit hotter-than-expected, that added to the uncertainty about what’s next with the Fed.4

So, try to stay focused, tune out the noise, and don’t get pulled into the guessing game “What the Fed is Going to do Next?” If you need a pep talk, give us a call.

1. CNBC.com, March 20, 2024. “Fed holds rates steady and maintains three cuts coming sometime this year.”

2. CNBC.com, April 5, 2024. “Fed’s Powell emphasizes need for more evidence that inflation is easing before cutting rates.”

3. Reuters.com, April 10, 2024. “US consumer prices heat up in March; see delaying Fed rate cut.”