Changes in 2024 College FAFSA Aid Formulas

Getting ready for higher education involves many steps, but one thing everyone has to cope with is the unexpected. While you can stay on top of everything happening with college financing issues, you can’t always rely on the information you have today being pertinent the next year. One big example of this is the recent changes to the Free Application for Federal Student Aid (FAFSA) process.

New Year, New FAFSA Rules for College Students

Changes to the formula used to determine aid eligibility and amounts received have potential implications for students and families seeking financial assistance for higher education. While students overall may benefit from increased funding, those with siblings in college are likely to experience a reduction in financial aid. The elimination of the sibling discount in the new formula means that families with more than one member in college will face an increased financial burden. Additionally, their eligibility for certain financial aid programs may be affected.1

Reduced Pell Grants Coming

Students from the lowest income levels may not be impacted by these changes. However, students from some families could experience reduced Pell Grants. The amount of aid from schools for these students may also be reduced compared to the current formula, potentially amounting to thousands of dollars less.

How Will the New Rules Effect You?

While some families may face disadvantages, the changes to FAFSA are expected to bring positive outcomes for the majority. The changes to FAFSA are likely to result in decreased aid eligibility for middle- and high-income families as the focus shifts from cash flow to a slightly greater emphasis on wealth.

In Summary

Changes like this underline the advantages your family has in forming your college financing strategy with a financial professional in the picture. Our iWealth Advisors are very enthusiastic about setting the families we work with on the path of saving and investing for college. We would love to set an appointment with you to discuss how these changes will effect your family’s financial situation.

References: 1. USA Today, April 30, 2023

Explore More

QCDs Explained – Turning Your RMD Into a Gift That Matters

Giving Back Generational Wealth Planning

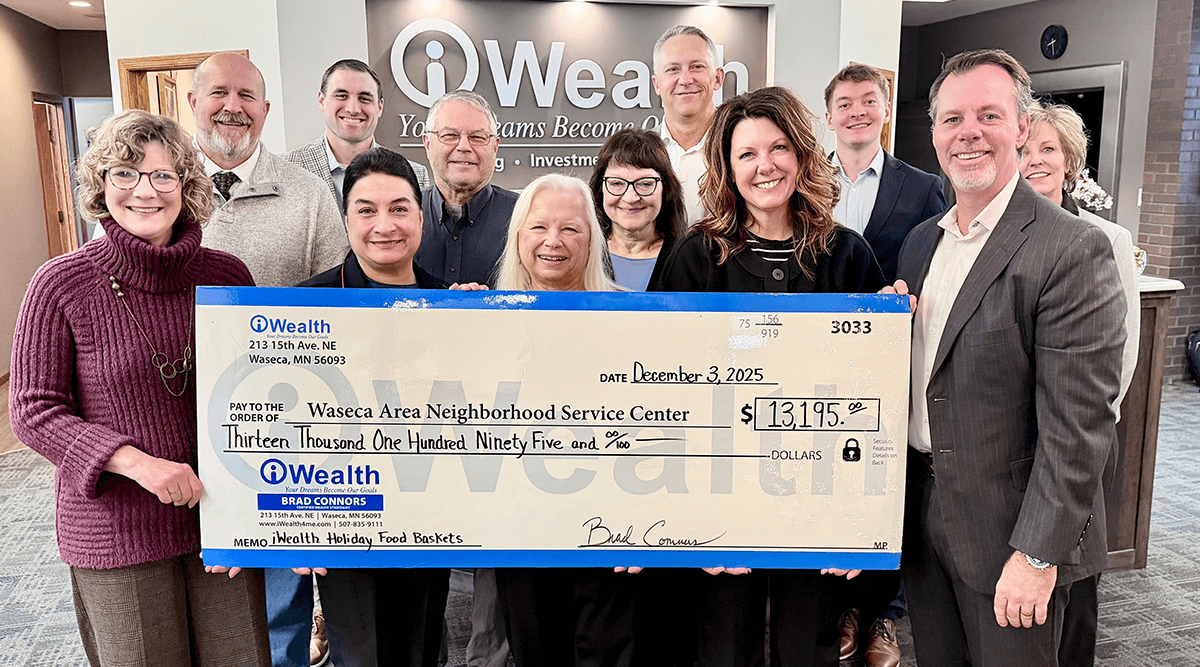

Sharing Warmth with the iWealth Holiday Food Baskets Drive

Giving Back iWealth Foundation

Strategic Year-End Gifting to Family and Charity

Generational Wealth Planning Leaving A Legacy